How Did Rockefeller Use Horizontal Integration

listenit

Mar 23, 2025 · 6 min read

Table of Contents

How John D. Rockefeller Used Horizontal Integration to Dominate the Oil Industry

John D. Rockefeller's name is synonymous with immense wealth and ruthless business tactics. While his philanthropy is undeniable, his path to becoming the world's first billionaire was paved with strategic maneuvers, the most significant of which was his masterful application of horizontal integration. This strategy, far from being a simple matter of buying up competitors, involved a complex web of tactics that allowed Standard Oil to achieve near-total dominance over the American oil industry in the late 19th century. Understanding Rockefeller's use of horizontal integration requires delving into the specifics of his methods, the challenges he faced, and the lasting impact of his actions.

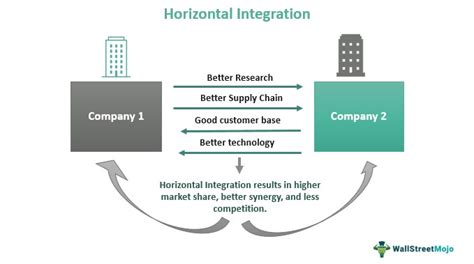

What is Horizontal Integration?

Before examining Rockefeller's methods, it's crucial to define horizontal integration. Unlike vertical integration, which involves controlling every step of the production process (from extraction to distribution), horizontal integration focuses on acquiring or merging with competitors operating at the same stage of the production process. In Rockefeller's case, this meant acquiring numerous oil refineries, eliminating competition, and consolidating control over refining capacity. This wasn't simply about buying out rivals; it was a sophisticated strategy involving a range of tactics designed to achieve and maintain market dominance.

Rockefeller's Tactics: A Multi-Pronged Approach

Rockefeller's success wasn't solely due to his genius; it was also the product of a multi-pronged attack on the nascent oil industry. His horizontal integration strategy encompassed several key tactics:

1. Ruthless Efficiency and Cost Reduction:

Rockefeller's Standard Oil wasn't just about acquiring refineries; it was about optimizing operations. His company implemented rigorous cost-cutting measures, streamlining production processes, and utilizing economies of scale. By refining oil more efficiently than competitors, Standard Oil could offer lower prices, driving smaller refiners out of business. This efficiency advantage was a critical component of his horizontal integration strategy, allowing him to undercut rivals even after acquiring them.

2. Strategic Acquisitions and Mergers:

Rockefeller didn't shy away from aggressive acquisitions. He used a combination of buying out competitors outright and negotiating mergers, often offering favorable terms to smaller companies facing financial difficulties. This allowed him to absorb their operations and expand Standard Oil's market share without engaging in protracted and costly legal battles. He expertly exploited the vulnerabilities of his rivals, using their financial weaknesses to his advantage. This wasn't merely about buying assets; it was about systematically dismantling the competition.

3. Undercutting Prices and Predatory Pricing:

One of the most controversial aspects of Rockefeller's strategy was his use of predatory pricing. Once Standard Oil had secured a significant market share, it could afford to temporarily lower prices below cost in specific regions to drive smaller competitors into bankruptcy. This tactic, while potentially illegal by modern standards, proved devastatingly effective in eliminating competition. Once rivals were bankrupt, Standard Oil could raise prices again, recouping its losses and maximizing profits.

4. Railroad Rebates and Exclusive Contracts:

Rockefeller cleverly secured preferential treatment from railroads, leveraging his enormous shipping volume to negotiate significant discounts and rebates. This gave Standard Oil a crucial cost advantage over its rivals, further enabling it to undercut prices and solidify its market position. In some cases, Standard Oil even secured exclusive contracts with railroads, effectively barring competitors from access to vital transportation networks. This strategic control over distribution channels was a masterful stroke of business acumen.

5. Control over Supply Chains:

Beyond refineries, Rockefeller understood the importance of controlling the entire oil supply chain. While his primary focus was horizontal integration through refinery acquisition, he also engaged in vertical integration to some extent, securing control over pipelines and distribution networks. This vertical expansion, while not as extensive as his horizontal strategy, complemented his overall goal of dominating the market. Securing control over the flow of oil was critical in maintaining his competitive edge.

6. Legal Maneuvers and Lobbying:

Rockefeller and his associates weren't afraid to use the legal system to their advantage. They employed skilled lawyers to navigate complex antitrust regulations (which were still in their infancy at the time) and to challenge legal actions brought against Standard Oil. Furthermore, they engaged in lobbying efforts to influence legislation and regulatory decisions in their favor, further strengthening their position in the market. This deft maneuvering in the legal and political arenas secured a protective shield around Standard Oil's dominance.

The Impact of Rockefeller's Horizontal Integration

The consequences of Rockefeller's horizontal integration strategy were profound and far-reaching:

-

Near-monopoly control of the oil refining industry: Standard Oil achieved an almost complete monopoly over oil refining in the United States, controlling over 90% of the market at its peak. This dominance allowed the company to dictate prices and profits, shaping the American economy in the process.

-

Transformation of the oil industry: Standard Oil's efficient operations and technological advancements transformed the oil industry, leading to improved refining techniques and increased production. While this positive development is undeniable, it was achieved at the cost of fierce and often ruthless competition.

-

Creation of vast wealth: Rockefeller's strategic brilliance translated into immense personal wealth, making him the world's first billionaire and establishing a legacy of extraordinary financial success.

-

Antitrust concerns and legal challenges: Standard Oil's dominance eventually attracted the attention of regulators and lawmakers, leading to prolonged antitrust litigation that ultimately resulted in the company's breakup in 1911. This event marked a watershed moment in American antitrust law and corporate history.

-

Long-lasting legacy: Even after its breakup, Standard Oil's legacy continued through its successor companies, such as ExxonMobil and Chevron, which remain some of the world's largest and most influential corporations. The organizational structure and business practices pioneered by Standard Oil continue to influence the modern corporate landscape.

The Ethical Considerations: A Complex Legacy

Rockefeller's methods were not without ethical controversy. Accusations of predatory pricing, monopolistic practices, and ruthless suppression of competition dogged him throughout his career. While his philanthropy is lauded, the means by which he amassed his wealth remain a source of debate and discussion. His actions raised significant questions about the balance between free-market competition and the potential for unchecked corporate power, questions that continue to be relevant today.

Conclusion: A Case Study in Strategic Domination

John D. Rockefeller's masterful application of horizontal integration stands as a compelling case study in strategic corporate dominance. His methods, while controversial, were undeniably effective. By combining operational efficiency, strategic acquisitions, predatory pricing, and shrewd manipulation of the legal and political systems, Rockefeller built Standard Oil into an unparalleled force in the American economy. While his legacy is complex and multifaceted, his use of horizontal integration remains a landmark achievement in business strategy, offering invaluable lessons for both aspiring entrepreneurs and students of economic history. His story serves as a potent reminder of the power of strategic planning, relentless efficiency, and the sometimes-murky ethical considerations involved in achieving such monumental success. Understanding his approach allows us to better analyze modern business strategies and consider the long-term societal implications of corporate power.

Latest Posts

Latest Posts

-

Cis 1 4 Dimethylcyclohexane Chair Conformation

Mar 24, 2025

-

What Is The Charge Of Nickel

Mar 24, 2025

-

Derivative Of 1 Square Root Of X

Mar 24, 2025

-

When Pressure Increases Then The Volume Must

Mar 24, 2025

-

Can A Trapezoid Be A Kite

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about How Did Rockefeller Use Horizontal Integration . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.