Round Your Answer To The Nearest Cent.

listenit

Mar 28, 2025 · 5 min read

Table of Contents

Round Your Answer to the Nearest Cent: A Comprehensive Guide to Rounding and its Applications

Rounding is a fundamental mathematical operation with widespread applications in various fields, from everyday finances to complex scientific calculations. Understanding how to round, particularly to the nearest cent, is crucial for accuracy and clarity in many contexts. This comprehensive guide will delve into the intricacies of rounding to the nearest cent, exploring its methods, practical applications, and potential pitfalls.

What is Rounding?

Rounding is the process of approximating a number to a certain level of precision. Instead of using the exact value, we replace it with a simpler, rounded-off version. This simplification is often necessary for readability, ease of calculation, or when dealing with values that inherently possess inherent limitations in precision (like measurements).

Rounding to the nearest cent, specifically, means approximating a monetary value to two decimal places. This is essential in financial transactions, accounting, and any situation where dealing with money is involved.

The Rules of Rounding to the Nearest Cent

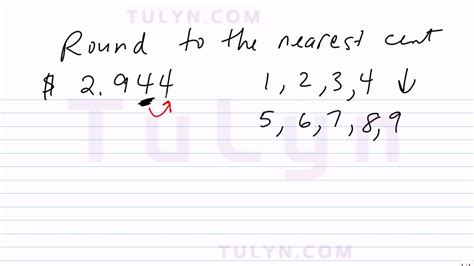

The core principle behind rounding is to examine the digit immediately following the desired precision point. In the case of rounding to the nearest cent (two decimal places), we look at the thousandths place (the third decimal place).

-

If the thousandths digit is 5 or greater (5, 6, 7, 8, 9), we round up. This means we increase the hundredths digit by one.

-

If the thousandths digit is less than 5 (0, 1, 2, 3, 4), we round down. This means we keep the hundredths digit as it is.

Let's illustrate with examples:

- $12.345 rounds up to $12.35 because the thousandths digit (5) is 5 or greater.

- $25.782 rounds down to $25.78 because the thousandths digit (2) is less than 5.

- $99.999 rounds up to $100.00 (Note the carry-over effect when rounding up to the next whole number).

- $0.004 rounds down to $0.00

Applications of Rounding to the Nearest Cent

Rounding to the nearest cent is ubiquitous in financial applications:

1. Retail Transactions:

Every purchase at a store involves rounding. The final price displayed usually reflects the value rounded to the nearest cent. Sales tax calculations often involve rounding as well.

2. Banking and Finance:

Banks and financial institutions round transactions to the nearest cent. Interest calculations, loan payments, and account balances are all affected by this rounding process.

3. Payroll and Salaries:

Paychecks reflect salaries rounded to the nearest cent. Tax deductions and other payroll deductions also undergo rounding.

4. Investment and Stock Markets:

Stock prices are typically displayed and traded with two decimal places, representing rounding to the nearest cent. Calculations involving investment returns and dividends also rely on this process.

5. Accounting and Auditing:

Accurate financial reporting necessitates rounding to the nearest cent to maintain consistency and clarity in financial statements. Auditors verify the correctness of these rounding procedures during audits.

6. Budgeting and Personal Finance:

When creating personal budgets or tracking expenses, rounding to the nearest cent simplifies calculations and provides a clear overview of financial positions.

7. Scientific and Engineering Applications (with caveats):

While less common than in finance, rounding can appear in scientific and engineering applications involving measurements and calculations where precision beyond two decimal places might be irrelevant or impractical. However, in situations requiring high accuracy, rounding should be applied carefully or avoided altogether, potentially using significant figures instead.

Potential Pitfalls and Considerations

While rounding to the nearest cent is a convenient practice, it's crucial to be aware of potential issues:

1. Rounding Errors:

Repeated rounding can lead to cumulative errors, particularly in large datasets or complex calculations. The small discrepancies from each individual rounding can accumulate to significant inaccuracies.

2. Transparency and Disclosure:

It's essential to be transparent about the rounding process, especially in financial reporting. The method used for rounding should be clearly disclosed to avoid misinterpretations or disputes.

3. Legal and Regulatory Compliance:

Some industries have specific regulations concerning rounding procedures. Understanding and adhering to these regulations is crucial to avoid legal issues.

4. Data Analysis and Interpretation:

Rounding can affect statistical analyses and data interpretations. If the data has been rounded, it's important to be mindful of this when performing statistical calculations or drawing conclusions.

Advanced Rounding Techniques

While rounding to the nearest cent is commonly used, there are more sophisticated rounding techniques:

1. Rounding Up or Down Consistently:

In certain applications, it might be necessary to consistently round up or down, regardless of the value of the thousandths digit. This is often done for safety reasons (rounding up in engineering to ensure sufficient capacity, for instance), or to account for potential losses (rounding up for transactions to avoid shortfall).

2. Banker's Rounding (Round Half to Even):

Banker's rounding addresses the bias introduced by always rounding 0.5 up. In this method, when the digit is exactly 0.5, it rounds to the nearest even number. This minimizes the overall rounding error over many calculations. For example, 2.5 rounds to 2, while 3.5 rounds to 4.

3. Rounding to Significant Figures:

This method focuses on the overall precision of the number, retaining a specific number of significant digits regardless of the decimal place. It's crucial in scientific and engineering contexts where the number of significant figures indicates the measurement precision.

Conclusion

Rounding to the nearest cent is a prevalent and indispensable process in numerous fields, primarily in finance. Understanding its rules, applications, and potential pitfalls is essential for accuracy, transparency, and legal compliance. By employing proper rounding techniques and being mindful of potential rounding errors, individuals and organizations can ensure the reliability and integrity of their calculations and financial reporting. Whether dealing with simple transactions or complex financial modeling, mastering the art of rounding to the nearest cent is a valuable skill that enhances accuracy and clarity. Remember that while convenience is a benefit, maintaining accuracy and transparency should always be the priority.

Latest Posts

Latest Posts

-

Phylogenetic Trees Are Used To Summarize

May 09, 2025

-

What Is Mercurys State Of Matter At Room Temperature

May 09, 2025

-

What Does The Graduated Cylinder Measure

May 09, 2025

-

Which Level Of Classification Is The Most Specific

May 09, 2025

-

Log X 4 Solve For X

May 09, 2025

Related Post

Thank you for visiting our website which covers about Round Your Answer To The Nearest Cent. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.