What Is Round To The Nearest Cent

listenit

Mar 18, 2025 · 5 min read

Table of Contents

What is Rounding to the Nearest Cent? A Comprehensive Guide

Rounding to the nearest cent is a fundamental concept in mathematics and finance, crucial for everyday transactions and accurate record-keeping. It involves adjusting a monetary value to the closest cent, simplifying calculations and ensuring clarity in financial statements. This comprehensive guide will delve into the intricacies of rounding to the nearest cent, exploring its applications, methods, and the importance of accuracy in different contexts.

Understanding the Basics: Cents and Decimal Places

Before diving into the mechanics of rounding, let's clarify the terminology. A cent is one-hundredth of a dollar ($0.01). When dealing with monetary values, we often encounter numbers extending beyond two decimal places (e.g., $12.345). Rounding to the nearest cent means adjusting these values to a maximum of two decimal places, representing the whole number of cents. This is crucial for practical purposes because we don't usually deal with fractions of a cent in daily transactions.

Why Round to the Nearest Cent?

Several compelling reasons exist for rounding to the nearest cent:

- Practicality: It's impossible to physically handle fractions of a cent. Cash transactions and most electronic payment systems only operate with whole cents.

- Simplicity: Rounding simplifies financial calculations, making them easier to understand and interpret, especially for non-financial professionals. Dealing with numerous decimal places can be confusing and prone to errors.

- Accuracy (within limits): While rounding introduces a small degree of imprecision, it minimizes the cumulative effect of tiny fractional amounts over numerous transactions.

- Standardization: Rounding to the nearest cent creates a standard for presenting monetary values, ensuring consistency and comparability across financial records.

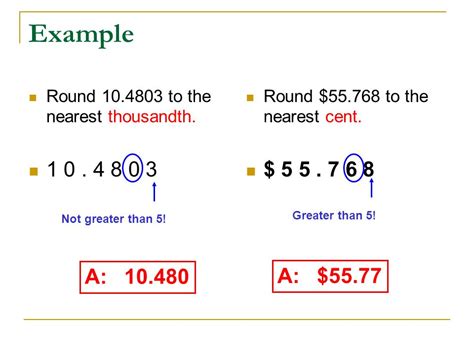

The Rules of Rounding to the Nearest Cent

Rounding to the nearest cent follows a straightforward set of rules:

-

Identify the third decimal place: Locate the digit in the thousandths place (the third digit after the decimal point).

-

Consider the third digit: If this digit is 5 or greater (5, 6, 7, 8, or 9), round the second decimal place (hundredths place) up by one.

-

Consider the third digit (continued): If this digit is less than 5 (0, 1, 2, 3, or 4), keep the second decimal place as it is.

-

Drop the remaining digits: After rounding, eliminate any digits beyond the hundredths place.

Examples:

- $12.345 rounds up to $12.35 (because 5 is ≥ 5)

- $25.982 rounds down to $25.98 (because 2 is < 5)

- $1.007 rounds up to $1.01 (because 7 is ≥ 5)

- $99.994 rounds down to $99.99 (because 4 is < 5)

Advanced Considerations and Special Cases

While the basic rules are relatively simple, certain situations require careful consideration:

Rounding with Multiple Cents

When dealing with numerous transactions or calculations involving many decimal places, the rounding process can accumulate small errors. This is particularly relevant in accounting and financial modeling. Techniques like using higher precision calculations during intermediate steps and only rounding at the final stage can minimize cumulative rounding errors.

The Banker's Rounding Method (or Round-Half-to-Even)

This method addresses potential biases associated with standard rounding. In standard rounding, if the third decimal place is exactly 5, we always round up. This can lead to a systematic upward bias over many transactions. Banker's rounding resolves this by rounding to the nearest even number when the third decimal place is exactly 5.

Examples:

- $12.345 rounds to $12.34 (because 4 is even)

- $12.355 rounds to $12.36 (because 6 is even)

This method ensures that rounding errors are distributed more evenly, minimizing bias in the long run. It's commonly used in financial applications to maintain fairness and accuracy.

Rounding in Different Currencies

The concept of rounding to the nearest cent applies to all currencies, but the specific unit of rounding varies. For example, in the Eurozone, the smallest unit is the cent, similar to the US dollar. However, some currencies have smaller subdivisions, requiring adjustments to the rounding rules to reflect the relevant unit.

Applications of Rounding to the Nearest Cent

Rounding to the nearest cent is integral to numerous aspects of finance and business:

- Sales Transactions: Point-of-sale (POS) systems automatically round transactions to the nearest cent.

- Payroll: Calculating net pay involves rounding deductions and contributions to the nearest cent.

- Financial Reporting: Financial statements, including income statements and balance sheets, present monetary values rounded to the nearest cent for clarity.

- Taxation: Tax calculations frequently involve rounding to the nearest cent to determine the amount owed or refunded.

- Investing: Stock prices and mutual fund values are usually quoted to the nearest cent, though underlying calculations may involve greater precision.

- Accounting Software: Accounting software packages utilize rounding functions to ensure accuracy and consistency in financial records.

The Importance of Accuracy and Avoiding Errors

While rounding is essential for practicality, it's crucial to be aware of the potential for errors and to implement strategies to mitigate these errors.

- Data Entry Errors: Care must be taken during data entry to avoid mistakes that could lead to incorrect rounding.

- Programming Errors: Errors in the programming logic of software applications could result in incorrect rounding.

- Cumulative Rounding Errors: As mentioned earlier, repeatedly rounding can accumulate small errors, impacting the accuracy of large-scale calculations.

- Rounding Inconsistencies: Using different rounding methods in the same calculation can lead to inconsistencies and inaccurate results.

To minimize errors:

- Double-check calculations: Manually verify critical calculations involving rounding.

- Use appropriate software: Employ reliable accounting and financial software to reduce the risk of manual errors.

- Maintain consistent rounding methods: Adhere to a single rounding method throughout a process to maintain consistency.

- Understand the implications of rounding: Be aware of the potential impact of rounding on the accuracy of financial statements and reports.

Conclusion: Mastering the Art of Rounding

Rounding to the nearest cent is a fundamental skill with widespread applications in various fields, particularly finance. While seemingly simple, understanding the nuances of rounding, including different methods and potential pitfalls, is crucial for ensuring accuracy and minimizing errors. By mastering the art of rounding, individuals and organizations can enhance their financial management practices and maintain the integrity of their records. Remember that while rounding simplifies things, it’s always essential to be aware of the limitations and potential inaccuracies it introduces, especially when dealing with significant sums of money or large-scale calculations. The knowledge gained from understanding rounding techniques will lead to better decision-making and improved financial practices. Applying this knowledge consistently will lead to more accurate and reliable financial outcomes.

Latest Posts

Latest Posts

-

What Is The Least Common Multiple Of 2 And 12

Mar 18, 2025

-

Simplify 1 X 1 1 X

Mar 18, 2025

-

5 Meters Is How Many Centimeters

Mar 18, 2025

-

What Is 13 16 As A Decimal

Mar 18, 2025

-

5 6 Divided By 2 7

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about What Is Round To The Nearest Cent . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.